lakewood co sales tax return form

Sales tax returns may be filed annually. If you cannot file through Revenue Online or another electronic method please download the form you need.

Business Licensing Tax City Of Lakewood

Colorado SalesUse Tax Rates For most recent version see TaxColoradogov.

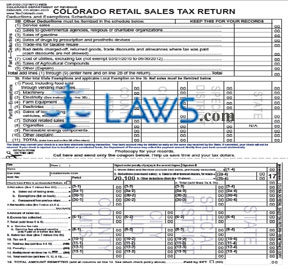

. Sales Use Tax Forms Instructions Retail Sales Tax CR 0100 - Sales Tax and Withholding Account Application DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR. Colorado Retail Sales Tax Return DR 0100 092721 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 TaxColoradogov DONOTSEND. Return form DR 1786 to register a Retail Delivery Fee account.

Lakewood residents could be eligible for receiving free tax help at the following locations. Lakewood receives approximately 81 of the property taxes paid by Lakewood residents or 08108 per. Filing frequency is determined by the amount of sales tax collected monthly.

Lakewood OH 44107 216 521-7580. Standard Tax Exempt Form. Examples of these improvements include curbs and sidewalks.

Return forms will not be mailed out by the City. We accept ach debit echecks credit cards and debit cards. Annual returns are due January 20.

City Income Tax Return for Individuals. The Lakewood sales tax. The PIF is a fee and NOT a tax.

And MAIL the return to City of Lakewood Division of Tax. Declaration of Estimated Tax for Business. Form Title Business Income Tax Registration.

Lakewood Business Pro Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Net Profit Return for Business. Building Use Tax Refund Application.

The December 2020 total local sales tax rate was also 7500. Form Instructions In preparing a. How to use the Standard Tax Exempt Form for non-profits and exempt organizations YouTube 2022 Forms.

City salesuse tax return. Beginning with sales on January 1 2018 the Colorado Department of Revenue. REVENUE DIVISION PO BOX 17479 DENVER CO 80217 Letter.

15 or less per month. Returns can be accessed online through Lakewood Business Pro with an established user account. Tax returnsforms file and pay online.

The lakewoods tax rate may change depending of the type of purchase. Average value of a single family home in Lakewood is 444181. Within designated areas of Southeast.

Therefore it becomes a part of the overall cost of the saleservice and is subject to sales tax. The current total local sales tax rate in Lakewood CO is 7500.

Sales Use Tax City Of Lakewood

Hands On Quickbooks Training Classes Lakewood Co Computers Provided

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller

Pre Owned 2018 Audi Q7 Near Ken Caryl Co Stevinson Lexus Of Lakewood

Free Form Dr0100f Retail Sales Tax Return 2011 Free Legal Forms Laws Com

Fillable Online City Of Lakewood Sales Use Tax Return Fax Email Print Pdffiller

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

How To Start A Business In Lakewood Ca Useful Lakewood Facts 2022

New Jersey Sales Tax Rate Rates Calculator Avalara

City Of Delta Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Denver Sales Tax Return Online Fill Online Printable Fillable Blank Pdffiller

Amazon Foreign Sellers U S Taxation And 1099 K Reporting O G Tax And Accounting

Colorado Department Of Revenue Facebook

Business Licensing City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Taxvalet Sales Tax Done For You Facebook

Business Licensing Tax City Of Lakewood

License My Business City Of Lakewood

Tax Preparation Accounting In Evergreen Co Robert Associates Llc